Company Overview

AI-Powered Decision Models & Analytics for Private Market Investments

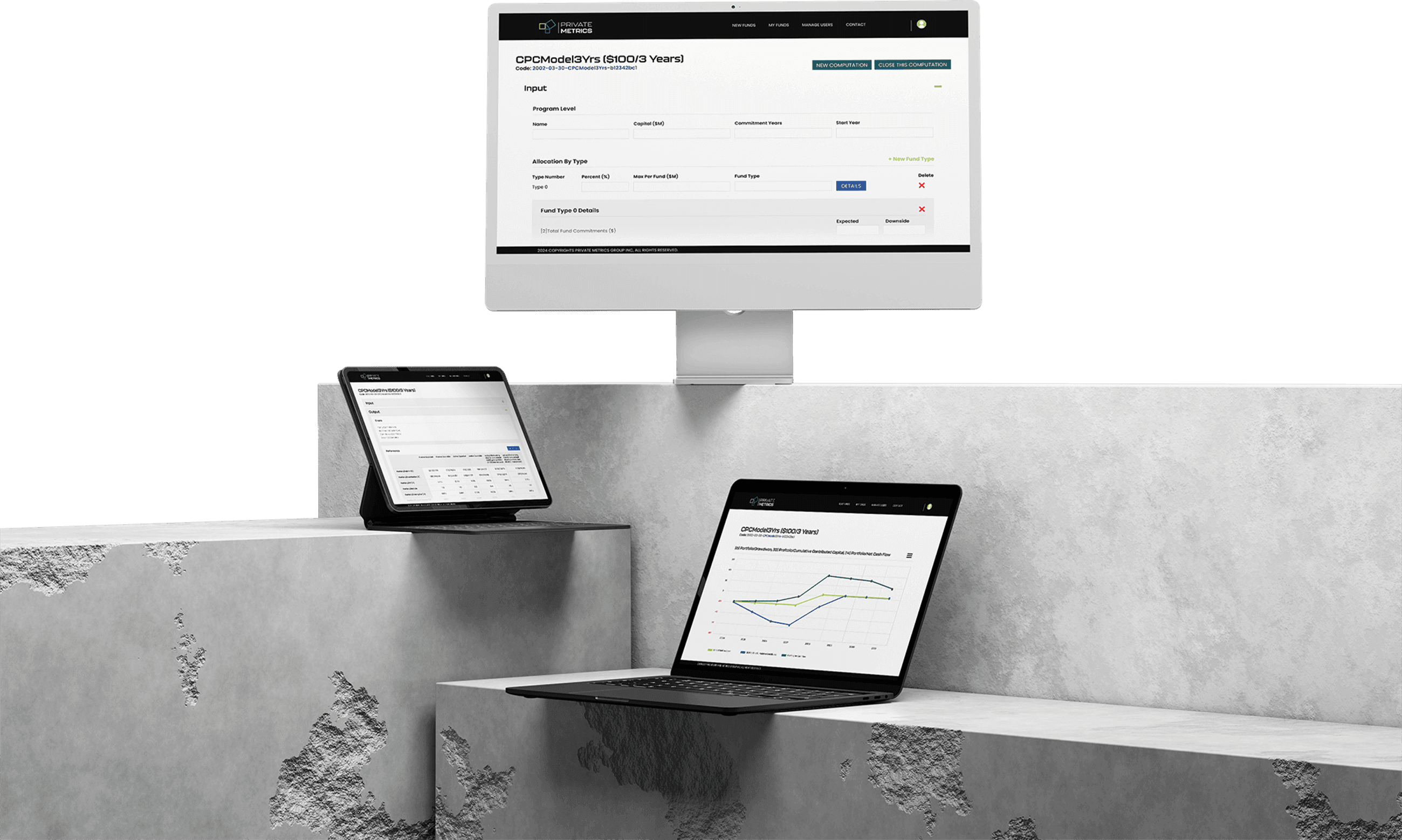

At PrivateMetrics, we specialize in designing, constructing, and managing private market fund program strategies that deliver both immediate value and long-term resilience. Our holistic approach integrates decades of institutional expertise with cutting-edge data science and AI-driven modeling to inform capital deployment, mitigate risk, and maximize returns.

Our decision and risk analytics platform is built on proprietary research, innovative technology, and billions in global private market advisory experience, encompassing venture, buyout, private debt, real estate, and evergreen funds. By continuously refining our machine learning algorithms with real-world insights, we help LPs, GPs, and institutional investors confidently navigate market cycles and pursue new opportunities in an ever-evolving investment landscape.

OUR MISSION

Empower investors with data-driven insights to optimize private fund programs.

Our Vision

Lead in AI-based decision and risk analytics for private fund investing.

Our Values

Innovation, Integrity, Excellence, Client Trust, and Success.

Our Approach: The Expertise Behind PrivateMetrics

At PrivateMetrics, we combine deep expertise in financial modeling, AI-driven investment strategies, and institutional portfolio management. Our team merges decades of real-world experience in private equity, public equity, and data science to deliver advanced, forward-looking solutions for investment decision-making.

Institutional Investment Expertise

Proven leadership managing multi-billion-dollar private equity, private debt, real estate, and evergreen portfolios, instilling confidence in data-driven results.

AI-Driven Investment Analytics

We apply machine learning, advanced financial modeling, and quantitative research to optimize private fund performance and risk management.

Product & Services

Discover the power of our AI-driven, web-based analytics platform, purpose-built for institutional investors and private equity service providers.

Investment Program Design & Strategy Formation

PrivateMetrics designs and optimizes private market investment programs, leveraging proprietary AI models to align capital deployment with LP objectives.

Evergreen Private Market Investment Programs

Our AI-powered dynamic capital deployment models sustain long-term programs through continuous reinvestment and precise liquidity forecasting.

Private Debt Investment Program Analytics

Our AI models capture private debt risk dynamics, assisting LPs in structuring private credit portfolios and evaluating mezzanine financing opportunities.

Commitment Pacing & Liquidity Planning

Advanced predictive modeling helps LPs manage capital commitments, optimize cash flow, and reduce overcommitment risk.

Risk Stress Testing & Scenario Modeling

AI-powered simulations test extreme market conditions, evaluating fund liquidity, return variability, and downside risk across multiple strategies.

Portfolio Optimization

Our AI-driven models maximize risk-adjusted returns and optimize capital deployment across private equity buyout, private credit, and real estate funds.

Waterfall & Carried Interest Modeling

Proprietary analytics illuminate GP/LP carried interest structures, enabling better negotiation of terms and economic alignment.

ESG & Sustainable Investing Analytics

Our AI-driven ESG modeling integrates sustainability metrics into private market portfolios, helping LPs align impact investing goals with financial performance.

Advanced AI & Machine Learning Integration

Gain insights at the investment, fund, and fund-of-funds levels. Our proprietary machine learning algorithms continuously refine strategies, offering adaptive insights in evolving markets.

Expert Witness & Litigation Support

Specialized forensic financial analysis for private equity disputes, including carried interest evaluations, valuation disagreements, and governance litigation.

AI-Driven Investment Solutions for Institutional Investors

PrivateMetrics delivers AI-powered investment analytics to help institutional investors, LPs, and private market professionals enhance portfolio allocation, optimize fund selection, and manage risk with precision. Our AI-driven models empower investors to make data-backed decisions in private equity, private credit, and alternative investment markets.

Institutional Investors (LPs):

Private Equity Funds(GPs):

Fund of Funds:

Service Providers:

Private Debt Investors:

Sequential Investment Decision Making:

Buyout & Real Estate Funds:

Private Market Insights & Resources

A knowledge hub for institutional investors and private fund professionals—featuring research, analytics, and strategic insights.

Blog & Industry Insights

Updates on private market trends, fund strategies, and risk mitigation.

Learn More

Webinars & On-Demand Events

Live and recorded sessions offering advanced private market investment decision-making insights.

Learn More

White Papers

In-depth research on commitment pacing, risk modeling, and fund performance—powered by machine learning.

Learn More

Research

Explore concise, AI-driven insights on private market strategies—from commitment pacing and performance forecasting to risk analysis.

Learn More

PrivateMetrics FundSim Lab

We explore and test innovative methods, technologies, and analytical frameworks to close data gaps and demystify private fund investing. Our multidisciplinary research blends advanced analytics, machine learning, financial economics, and quantitative simulations—delivering transparent, actionable insights for institutional investors.

Learn MoreGet in Touch

![]() hello@privatemetrics.ai

hello@privatemetrics.ai